Incumbent banks often maintain an informational monopoly over their borrowers, making it difficult to switch to competing lenders or negotiate better terms. This column argues that deposit relationships could be a solution, thereby contributing to more competitive lending markets. It shows that firms with deposit relationships at competing banks are significantly more likely to switch lenders. In turn, banks offer better loan terms to firms that maintained a deposit account with them. The findings have implications for current policy initiatives, such as open banking and data sharing, deposit market reform, and competition policy.

A key challenge for policymakers aiming to improve small businesses\’ access to competitive financing is that incumbent banks maintain an information monopoly over their borrowers, making it difficult for small businesses to switch to competing lenders or negotiate better loan terms. This information monopoly essentially allows incumbent banks to charge higher interest rates and extract informational rents, leading to hold-up problems and investment inefficiencies (Sharpe 1990, Rajan 1992, Schenone 2010). In a recent paper (Cao et al. 2024), we uncover that deposit relationships could be a solution to this hold-up problem, thereby contributing to more competitive lending markets. In particular, we show that deposit relationships between firms and competing banks can mitigate incumbent banks’ information monopoly, thereby improving firms’ ability to switch to new lenders and obtain competitive loan terms.

The power of deposit relationships

Using comprehensive data on deposit and loan relationships between firms and banks in Norway, we find that deposit relationships significantly reduce incumbent banks\’ information advantage. This stems from the fact that when firms maintain deposit accounts with multiple banks, competing lenders can observe valuable information about the firm\’s financial health through their transaction history. This information helps level the playing field between incumbent and competing banks.

The impact is substantial. Our analysis shows that firms with deposit relationships at competing banks are eight percentage points more likely to switch lenders – a 50% increase over the baseline switching rate.

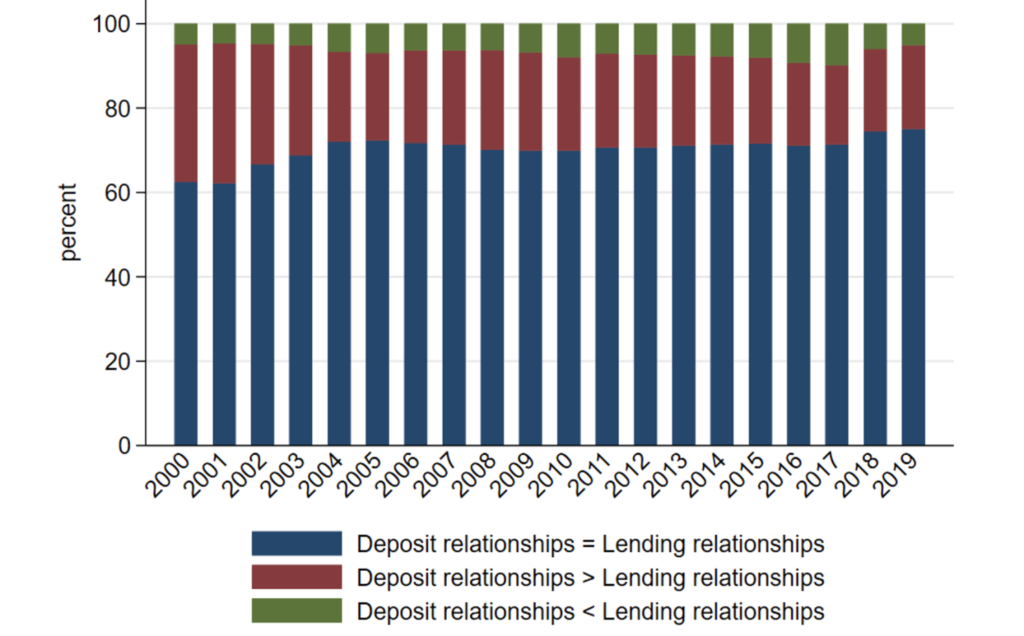

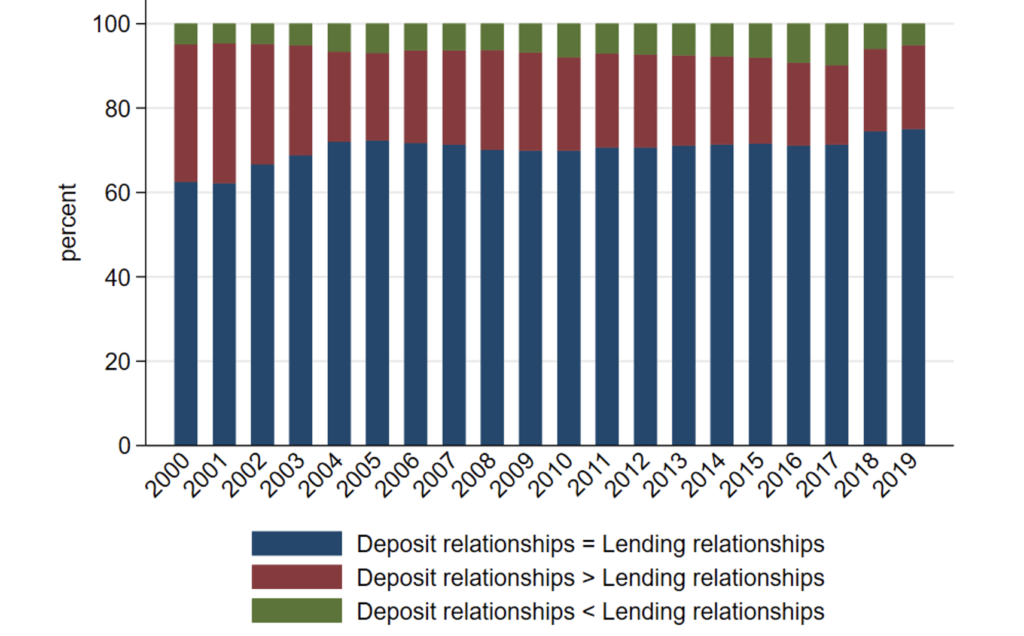

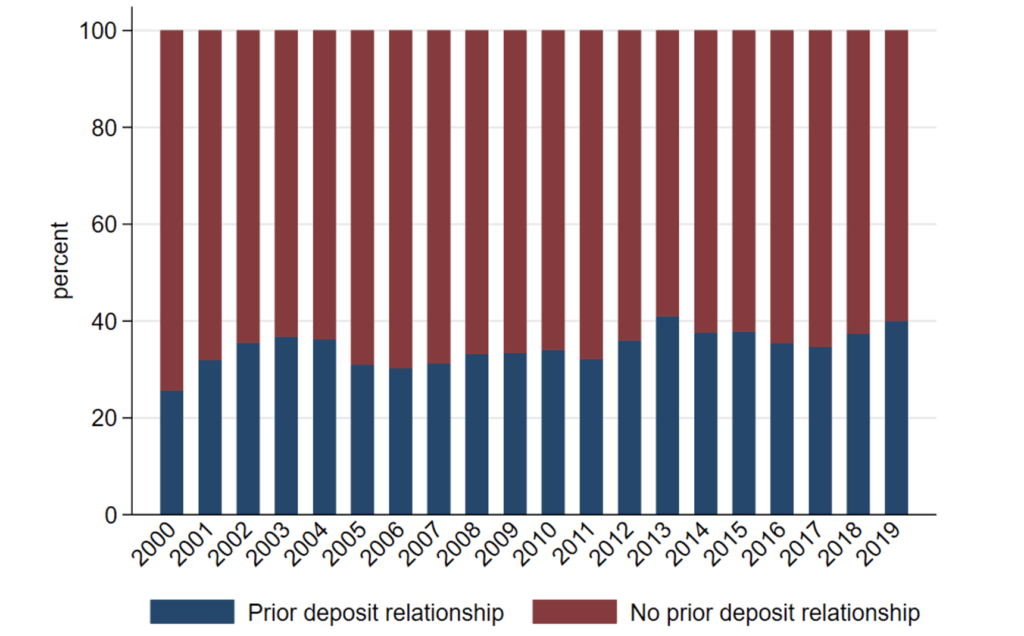

As shown in Figure 1, about 20% of firms maintain more deposit relationships than lending relationships, creating opportunities for increased competition. Furthermore, our data reveal that approximately 40% of firms that successfully switch lenders had a pre-existing deposit relationship with their new bank (Figure 2).

Figure 1 The structure of firm-bank relationships

Note: Authors’ own computations. This figure shows the proportion of firm-bank relationships that consist of both a deposit and a lending relationship in blue, only a deposit relationship in red, and only a lending relationship in green. The sample comprises all firm-bank deposit and lending relationships of firms with at least one lending relationship operating in Norway between 2000 and 2019.

Figure 2 Proportion of switching firms with pre-existing deposit relationships

Note: Authors’ own computations. This figure shows the proportion of switching firms that had a deposit relationship with their new (outside) lender prior to switching in blue, and the proportion of switching firms that did not have a deposit relationship with their new (outside) lender prior to switching in red. The sample comprises all switching firms operating in Norway between 2000 and 2019.

Firms that switch to banks where they had deposit relationships also benefit from better loan conditions, as we find that competing banks offer much better loan terms to firms that maintained a deposit account compared to firms that did not.

Why deposit relationships matter

Consistent with the idea that these results are driven by the information value of deposit relationships, we show that (1) our results are strongest for transaction accounts, which provide detailed payment data, (2) our results are stronger if competing banks\’ information disadvantage is more pronounced, for example for young (informationally opaque) firms, and (3) deposit relationships improve banks’ ability to screen potential borrowers.

This suggests that observing firms\’ deposit account activity helps banks overcome the ‘winner\’s curse’ that typically prevents them from competing aggressively for firms that have lending relationships with other banks.

Policy implications

Our findings have important implications for current policy initiatives:

- Open banking and data sharing. The information value of deposit relationships that we document provides support for expanding open banking frameworks that give firms greater control over their transaction data. By allowing firms to easily share their banking history with potential lenders, policymakers could foster more competitive credit markets (also see Babina et al. 2024).

- Deposit market reform. Efforts to reduce switching costs in deposit markets – such as the EU Payment Services Directive 2 that reduces the administrative burden of opening a deposit account – may have positive spillovers on credit markets. More broadly, making it easier for firms to open deposit accounts with multiple banks could ultimately increase lender competition.

- Competition policy. Banking regulators should consider how deposit market structure affects lending market competition. Policies that maintain healthy competition in deposit-taking could have positive spillovers on firms’ access to competitive financing (also see Drechsler et al. 2017).

Looking ahead

While much attention has focused on direct measures to increase lending market competition, our research suggests that deposit market dynamics play a crucial and often overlooked role. As policymakers continue to develop frameworks for open banking and data sharing, understanding these linkages between deposit and lending relationships becomes increasingly important.

Our study therefore opens new questions about the interconnected nature of banking markets. How might digital banking and fintech innovations affect these dynamics? Could alternative data sources serve a similar role in reducing information asymmetries? As the financial sector continues to evolve, these questions will be crucial for designing effective policy frameworks that promote competitive and efficient banking markets.

Source: cepr.org